Checkout Failure with PayPal & How Fondy Helped to Fix it Resulting in More Vendor's Sales

68%+ Conversion Rate

ROLE

Senior Product Designer

TIMELINE

8 Weeks (Early 2025)

TEAM

CEO/Founder & Myself

Overview

When most customers chose PayPal at checkout, it looked like a win. But behind the scenes, 84% of failed transactions were traced to PayPal login issues. We'd also integrated Stripe, which had a 94% success rate, but lacked support for international vendor payouts, an essential requirement for our marketplace.

As Senior Product Designer, I led a full redesign of our payment experience, collaborating directly with the CEO/founder and driving strategy, research, decision-making, and vendor-facing UX.

The Challenge

We uncovered through customer complaints, GA4, and Hotjar that most checkout failures were due to PayPal login issues. Although Stripe performed well, it didn't support cross-border payouts so it wasn't a standalone solution.

The bigger challenge:

Customers, who needed a smooth checkout

Vendors, who required reliable payout processing

Our marketplace team, who needed a scalable, low-maintenance system

How We Evaluated Payment Options

I led the evaluation process by building a custom comparison spreadsheet that broke down each provider across the dimensions that mattered most.

Vendor criteria: I assessed each provider’s onboarding flow, KYC process, documentation clarity, and fraud support. The goal was to ensure vendors could sign up smoothly without frequent support dependencies.

Customer experience: I evaluated the mobile checkout experience, clarity of the payment journey, and support for flexible payment options like installments all essential for conversion and trust.

Marketplace ops: I reviewed payout logic, transaction fees, compliance readiness, and overall integration effort to make sure the provider could scale with our infrastructure.

This evaluation framework allowed us to have structured conversations with stakeholders, make trade-offs visible, and helped us make an informed, confident decision. Few scored above 75% across all categories.

Initiating the Partnership

After mapping out a scoring matrix with key variables across all stakeholders customers, vendors, and our internal ops team, we shortlisted top PayPal alternatives like MangoPay, Trustap, Mollie, and Fondy. I booked technical discovery calls with each provider to explore how well they aligned with our needs.

In those meetings, we evaluated:

Vendor Onboarding Workflow & KYC Timelines: Explored step-by-step onboarding, regional document requirements (UK focus), and how we could preempt friction points via embedded help or triggers.

Payment Processing, Fees & Transaction Tracking: Clarified fee structures, chargeback policies, and how we could monitor real-time transaction states from both user and vendor perspectives.

UX Customization & API Capabilities: Evaluated how Fondy's APIs could support dashboard personalization, mobile-first optimization, and whether we could tailor flows without disrupting compliance.

Vendor Onboarding Experience

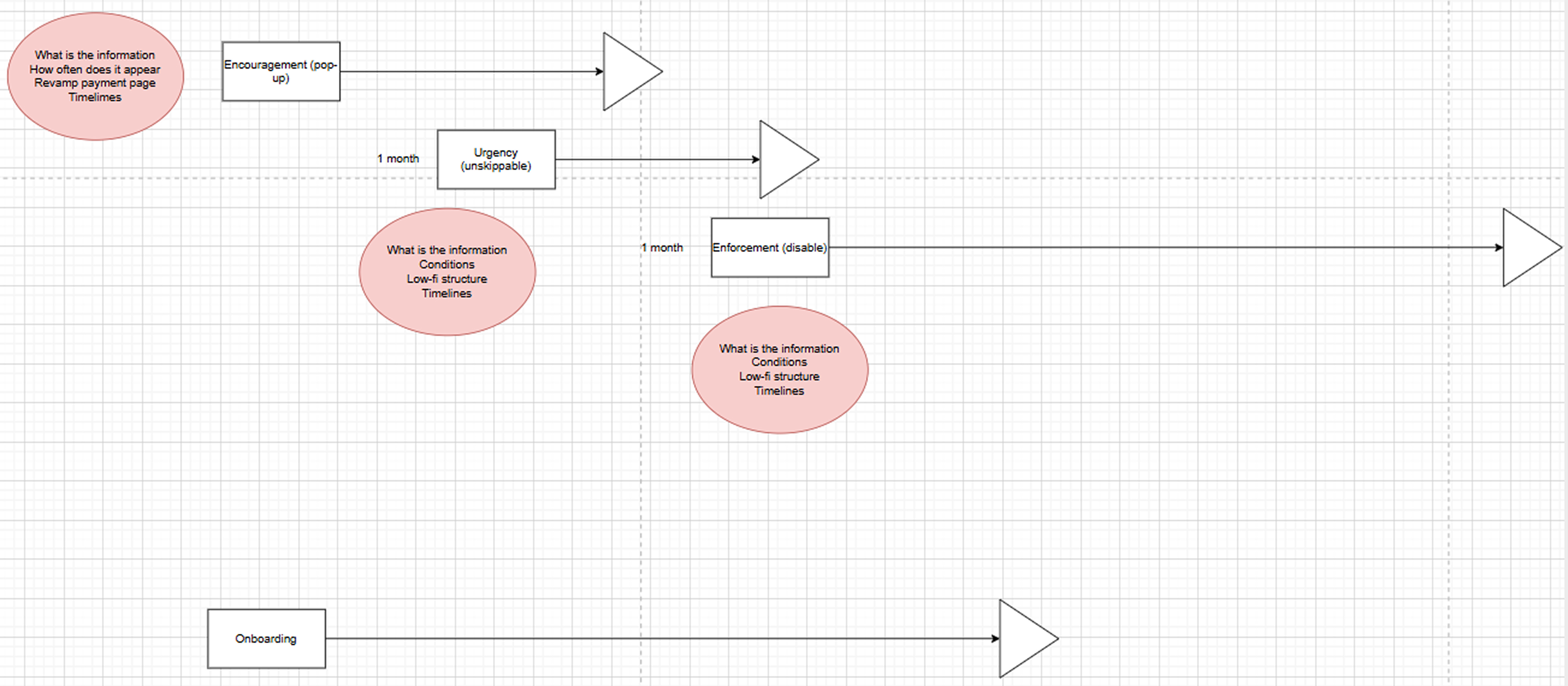

Since vendors were critical to the marketplace’s success, I designed their onboarding experience with a state-based approach that prioritized transparency, guidance, and autonomy. The goal was to reduce confusion and support smooth, self-serve adoption of Fondy. Vendors were central to success and sales, so I focused on clarity and control in their vendor panel & onboarding flow:

Not Onboarded: Pop-ups and banners to explain benefits and next steps

In Progress: Step-by-step guide, status indicators, and a "Contact Support" CTA

Fully Onboarded: Clean interface showing transaction history, settings, and payouts

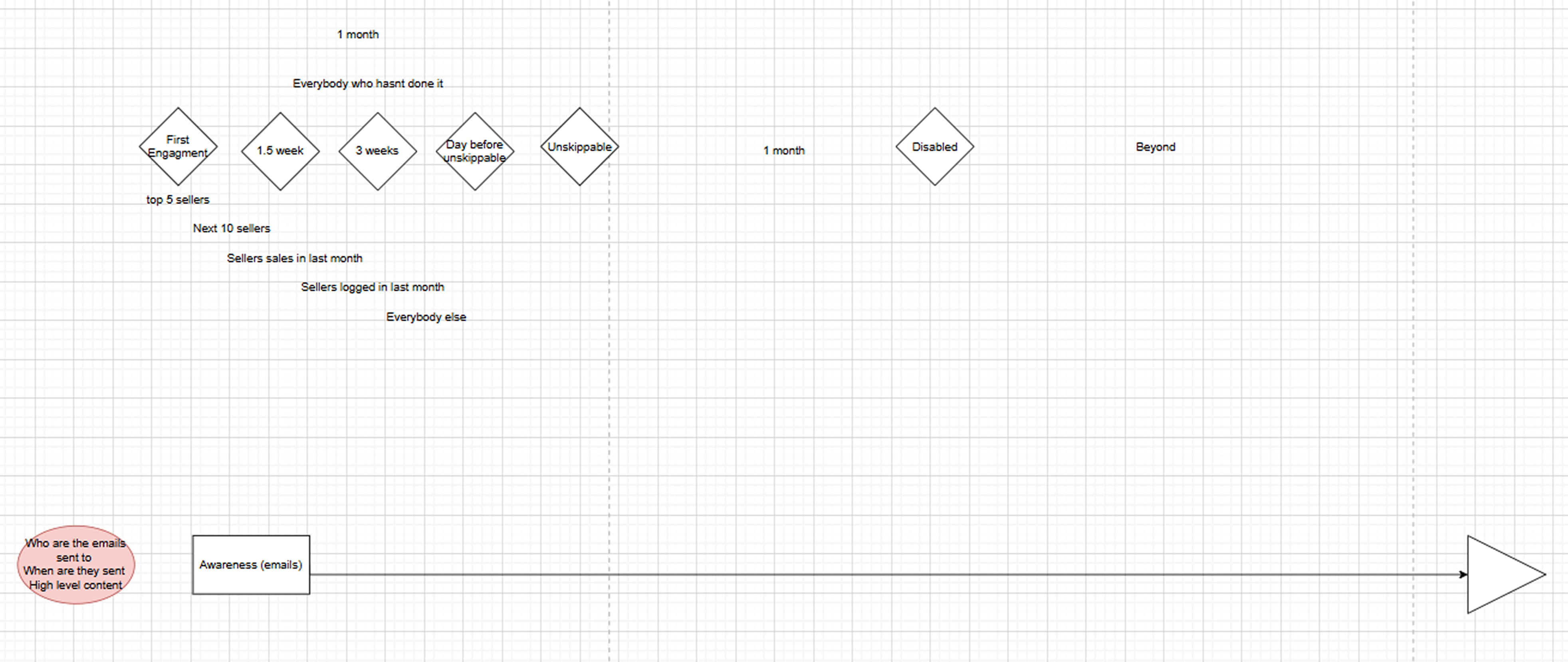

Rollout Plan

| Phase | Timeline | Action |

|---|---|---|

| Phase 1 | Week 1 | Onboarded 10 top vendors with close support |

| Phase 2 | Week 3 | Expanded rollout to next 50 vendors with live help |

| Phase 3 | Week 4 | Activated dashboard banners + email reminders |

| Final Phase | Week 8 | Mandatory switch no more PayPal payouts or account blocked |

Challenges & How We Solved Them

Some vendors were hesitant to switch concerned about technical friction, disrupted payouts, or simply the fear of change. To build trust and ease the transition, I implemented a multi-layered support and communication strategy.

Phased onboarding with a small, trusted vendor group to de-risk rollout

In-product support via contextual popups, banners, and knowledge base links

Clear messaging focused on benefits: faster payouts, fewer errors, intuitive dashboard

Measurable Outcomes

The switch to Fondy resulted in tangible improvements across core business metrics:

| Metric | Paypal | After Fondy |

|---|---|---|

| Payment Failures | 84% (via PayPal) | <12% (Fondy + Stripe) |

| Vendor Onboarding Rate | 23% | 100% in 60 days |

| Cart Abandonment Rate | High | ↓ 28% |

| International Payout Support | Yes | Fully enabled |

UX Walkthrough

Impact & Results

28%

Reduction in cart abandonment

100%

Vendor onboarding completed

31%

Uplift in successful intl. transactions

84% → 12%

Payment failure drop

Key Learnings

Product Thinking at Scale

This wasn't just a payment switch. It required balancing business, design, and engineering goals.

Empathy in Rollout

We rolled out sensitive changes through clear vendor communication and opt-in onboarding paths.

Backend → Frontend Clarity

Translating technical backend logic into clean vendor dashboards improved adoption massively.

Data-Driven Design

Every decision was backed by metrics — from checkout drop-offs to success rates by provider.

Product Thinking at Scale

This wasn't just a payment switch. It required balancing business, design, and engineering goals.

Empathy in Rollout

We rolled out sensitive changes through clear vendor communication and opt-in onboarding paths.

Backend → Frontend Clarity

Translating technical backend logic into clean vendor dashboards improved adoption massively.

Data-Driven Design

Every decision was backed by metrics — from checkout drop-offs to success rates by provider.